Luckin Coffee 今天爆出虚报3.1亿美金(22亿人民币)后股价暴跌。

第一时间想到的是2001年的安然事件。

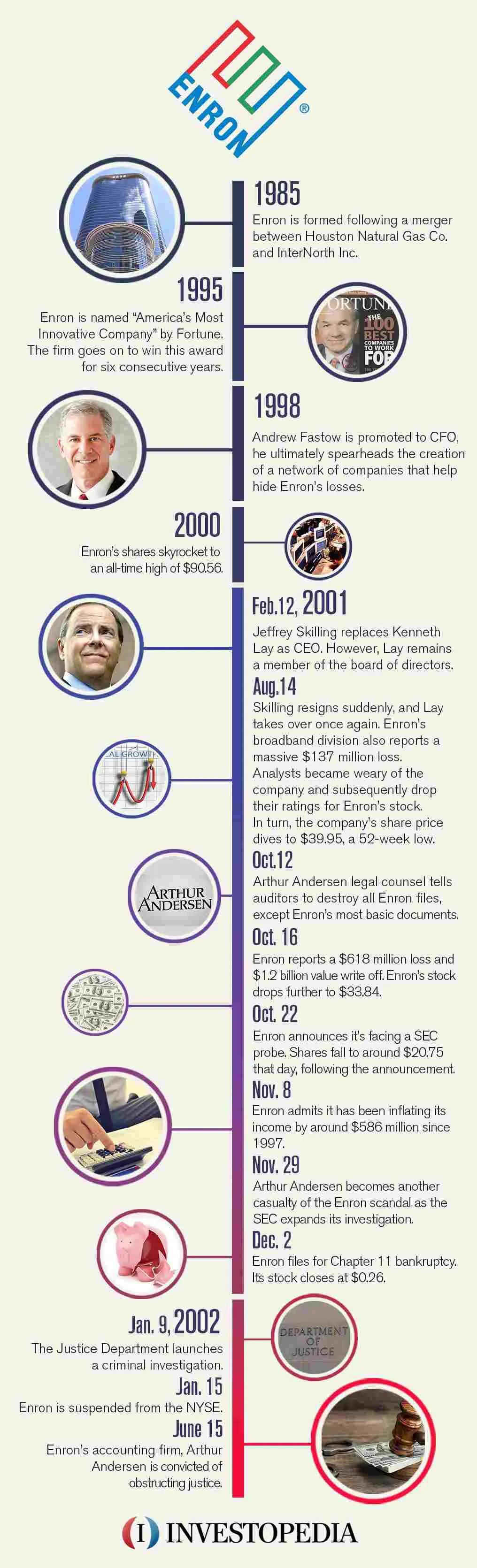

这是安然当时的情况。

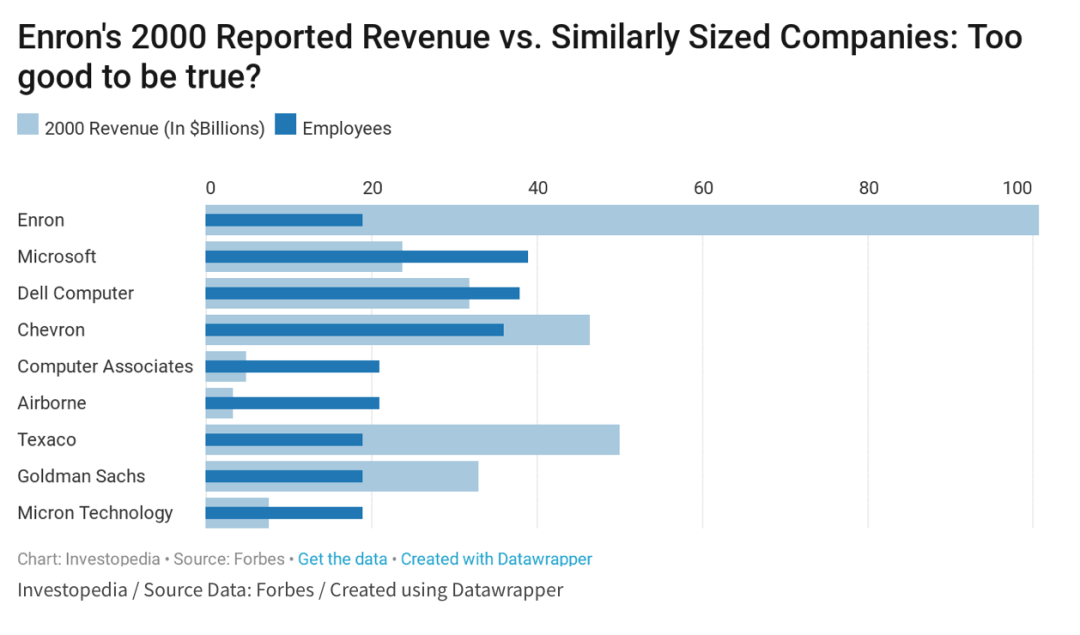

这是安然和当时的几个美国明星企业的对比。

安然事件的整个事件轴

这是今天的 Luckin Coffee

下面是Bloomberg 关于Luckin 的报道

原标题: Luckin, China’s Starbucks Rival, Plunges 81% on Accounting Probe

原作者: Jonathan Roeder

Luckin Coffee Inc. plunged as much as 81% on Thursday after the company said its board is investigating reports that senior executives and employees fabricated transactions.

The company’s announcement that Chief Operating Officer Jian Liu and several employees reporting to him engaged in misconduct casts doubt on the foundations of the Chinese coffee chain’s meteoric rise and its emergence as a key competitor to Starbucks Corp.

Liu and others have been suspended and investors shouldn’t rely on previous financial statements for the nine months ended Sept. 30, the company said. The transactions in question occurred last year and totaled about 2.2 billion yuan ($310 million), according to the filing.

“Certain costs and expenses were also substantially inflated by fabricated transactions during this period,” Luckin said, while noting the special board committee investigating the matter hasn’t independently verified the figure.

The coffee chain, founded in 2017, operated about 4,500 stores by the end of 2019 in China, and has aimed to upset Starbucks’ dominance of the Chinese market. Its goal had been to open 10,000 stores by the end of 2021.

The shares plunged after Muddy Waters tweeted on Jan. 31 that the company had a short on the stock after it received what it called a “credible” unattributed 89-page report that alleged accounting issues with the chain and a broken business model. Luckin Coffee denied the allegations.

That followed the company raising $778 million from a share sale and a convertible bond offering in early January, according to people familiar with the deal. The company raised $645 million in a U.S. listing in May 2019.

读一手文字,不看二手观点

本文源自微信公众号:LABcircle