原标题:The Best and Worst U.S. Airlines of 2019

原作者:Scott McCartney

原刊于:Wall Street Journal

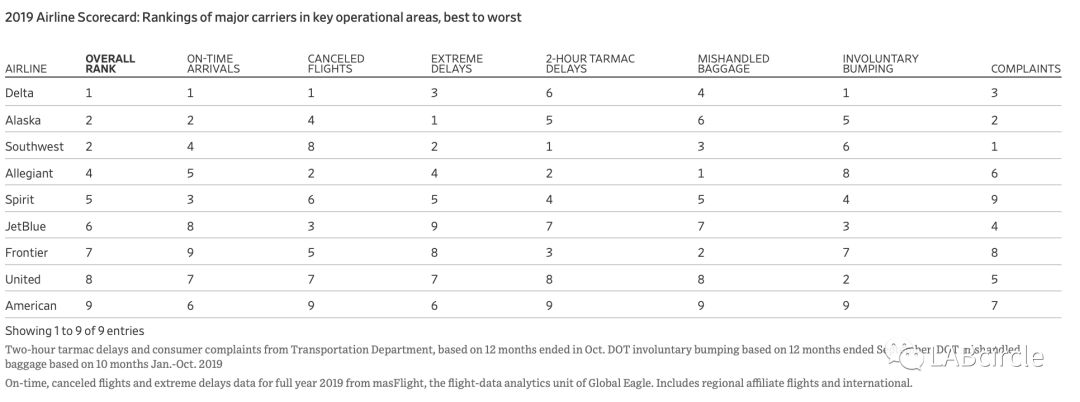

Flight cancellations increased. So did long delays, bumping ticketed passengers and consumer complaints.

Overall, 2019 was a frustrating year for many U.S. travelers. But the travel pain wasn’t evenly distributed.

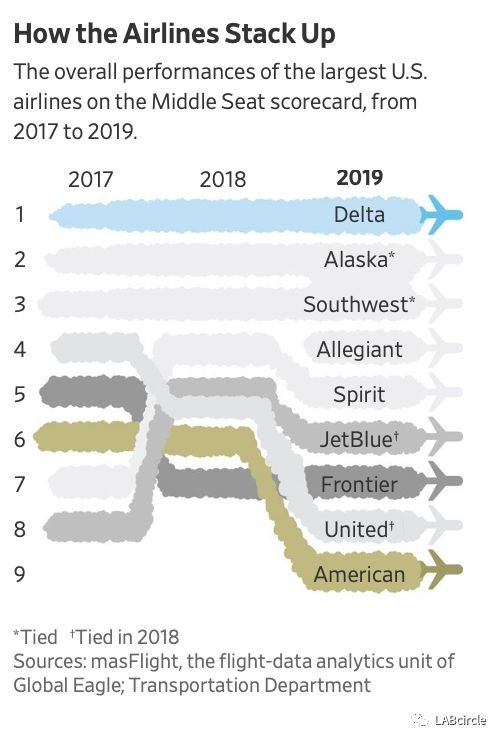

Delta excelled and finished at the top of the Middle Seat Scorecard for the third year in a row. At the bottom of the rankings? American, for the third year in the past five. Those two airlines were on different flight paths in 2019.

Just consider the difference in flight cancellations. Delta averaged only 36 a day in 2019; American averaged 159 a day. In mishandled baggage, Delta averaged 1,345 late or lost bags each day; American mishandled more than twice as many. And Delta involuntarily bumped a total of nine passengers from its flights over the most recent 12-month period reported; American bumped more than 15,000.

Airlines say 2019 had stronger everyday storms and more congestion on air-traffic routes and big airports than 2018. They expect things to get even worse this year.

“Climate change is here. We are seeing worsening weather and much more intense and longer-duration weather events,” says Jim DeYoung, vice president of network operations at United, which finished next-to-last in the overall rankings. “We have to get better at the operational impact of that.”

Despite the weather and congestion, Delta improved its on-time arrival rate to 83.4%, up from 82.9% in 2018, according to masFlight, the flight-data analytics unit of Global Eagle, which supplies services to airlines, cruise ships and others. Delta finished significantly ahead of Alaska, which placed second in the on-time category, and a full 10 percentage points ahead of last-place Frontier in the on-time category.

On-time is a crucial measure of airline performance. Airlines that run punctually are not only more reliable for customers but also less likely to misconnect baggage or end up canceling flights at the end of a day. Many factors go into on-time performance: how the airline has scheduled the flight, what kind of preventive maintenance is done on the fleet, how many spare planes and reserve crew members might be available and how the airline recovers from storms and other disruptions.

“While the weather itself is out of our control, how we react to that weather, plan for that weather and work through that weather is certainly within our control,” says Dave Holtz, Delta’s senior vice president over the airline’s operations center.

Delta’s industry-leading cancellation rate continues to improve. The airline canceled just 0.7% of its flights in 2019, including regional partners, down from 0.9% in 2018. Southwest, American and United all canceled more than 2% of their flights last year, and the industry average was 1.85% in 2019.

Delta says its mainline operation had 281 days with zero cancellations last year, 30 more than in 2018. Factoring in regional partners, the total number of days when 100% of flights were completed was 165, up from 143 in 2018.

American had the same on-time arrival rate as the previous year, better than United, JetBlue and Frontier. That’s somewhat surprising, given the American’s 2019 labor headwinds.

Cancellations were actually down slightly at the largest U.S. airline, but still high compared with others. Long delays, complaints and bumping passengers were all up. And American remained in last place in baggage handling.

For more than half of 2019, a contract dispute between American and its mechanics was essentially negotiated on the tarmac, with passengers paying a heavy price. From mid-February through late August, American had a high number of planes out of service each morning, forcing cancellations and delays and leaving customers stranded. The airline got a federal judge to order mechanics to end a work slowdown in June, but the dispute continued through the peak summer season.

During the height of the slowdown, American started each day with about 50 planes out of service for mechanical reasons. Normally the airline has about 30 aircraft needing repairs even after overnight work by mechanics. Being short 20 airplanes a day means the airline had to cancel about 80 flights for maintenance.

At that point, says David Seymour, senior vice president of operations at American, “you’re piecing things together as best you can.”

Once the labor disruption ended, American ran a smooth operation from September through the end of the year, with no mainline cancellations on 15 of the last 45 days of 2019, he says. The best the airline has done on perfect days previously was 15 in the entire year of 2017.

“The part of last year that I want to remember is really the first month and the last four,” Mr. Seymour says.

American still hasn’t reached a new contract with its mechanics. Should the labor dispute flare again, American will likely adopt a different strategy and shrink its schedule so it would have enough planes to fly more reliably, he says.

“We would not take our passengers and team members through it again,” Mr. Seymour says.

The 12th annual Middle Seat Scorecard ranks nine major U.S. airlines on seven areas key to travelers. The data come from masFlight and the U.S. Department of Transportation and in most categories include each airline’s regional partner flights.

This year, we included Allegiant because the airline was required to report operational performance statistics to the Transportation Department for the first time. Allegiant, a Las Vegas-based discount carrier that primarily flies to small towns and secondary airports, finished in fourth place overall.

The Scorecard doesn’t measure factors like opinions on seat comfort, gate agent and flight attendant service, ticket prices and add-on fees, frequent-flier programs, upgrades or route convenience, except when complaints show up at the Transportation Department. But it does give travelers a thorough, data-based evaluation of airline reliability, and the rankings, now closely watched by airlines, highlight poor service and pressure carriers into improvements.

Southwest and Alaska tied for second overall in the latest Scorecard. Alaska has been first or second in the rankings since 2010. Southwest finished in third place the previous two years.

Alaska saw some of its operational performance weaken a bit in 2019 compared with 2018. Alaska’s on-time arrival rate was down slightly. Cancellations and delays of 45 minutes or longer increased a bit. Alaska reduced its involuntary denied boarding and fared slightly better in the percentage of passengers filing complaints at the Transportation Department.

Southwest had a better year despite a contract battle with mechanics early in the year that disrupted flight operations for many travelers. Southwest’s cancellation rate for the year jumped to 2.5% from 1.4%. But flying got smoother after mechanics ratified a new contract in May. For the year, Southwest’s on-time rate, 45-minute delays, bumping and complaints all improved over 2018.

The Boeing 737 MAX grounding, which affected Southwest, American and United, doesn’t show up much in these operational numbers after the first week of grounding. Once the MAX was taken out of schedules, those flights aren’t counted. The MAX grounding had some lingering effect on bumping passengers. American says it replaced some 172-seat MAX flights with 160-seat jets that left the flights overbooked. Airlines can, however, reduce bumping by sweetening offers for passengers to give up seats and voluntarily take later flights.

United tied for fifth place in 2018, but this year dropped to next-to-last, its worst showing in five years. United had more delays and cancellations in 2019 compared with the previous year. It was fourth-best in baggage handling in 2018 but dropped to No. 8 in baggage in 2019. On the plus side, United, after the 2017 incident where a passenger was dragged off an airplane, continues to reduce its involuntary denied boarding. Only 107 passengers out of 147 million were bumped in the 12 months ended in September, the most recent reported by the Transportation Department.

United says it had more unexpected problems in 2019, but is investing in tools to help customers when there are disruptions. That includes holding flights for late-arriving connecting customers at the end of the day without creating additional delays and pushing more text messages about delays and cancellations with detailed explanations and more opportunity to change plans.

“Those tools came at just the right time for really a tough weather year for us and for all the carriers,” United’s Mr. DeYoung says. “From a customer perspective, you are starting to see United making significant investments and changes in how we react to irregular operations.”

Why Not Hawaiian?

It’s worth noting that the Scorecard doesn’t include Hawaiian Airlines. If included, Hawaiian would be No. 1. But Hawaiian has a big chunk of its business in short hops between islands where the weather is, well, paradise. Such limited exposure to the mainland distorts comparisons. Hawaiian argues it should be included because it faces maintenance issues, baggage handling, crew scheduling and other aspects just like any other airline.

本文源自微信公众号:LABcircle